By Belle Owen

There is plenty of information on how to start your National Disability Insurance Scheme (NDIS) plan off right, setting up supports and allocating budgets. There’s also plenty of advice on what to do when your NDIS plan is coming to an end, but what about those of us that are somewhere in the middle?

Ideally, around the six-month mark of your plan (or year mark if it’s a two-year plan) you should be around halfway through your total budget. There may be reasons for being off the mark, like larger home modifications or expensive technology purchased in one half of the plan, but generally you want to have about half of the money left to receive consistent and ongoing supports. Spending too much is a problem – but so is not spending enough! Your plan is designed to allow you to reach your potential and live your best life, so make the most of it. If you have a plan manager, they should be helping you with a budget plan that gets you as much value from your plan as possible.

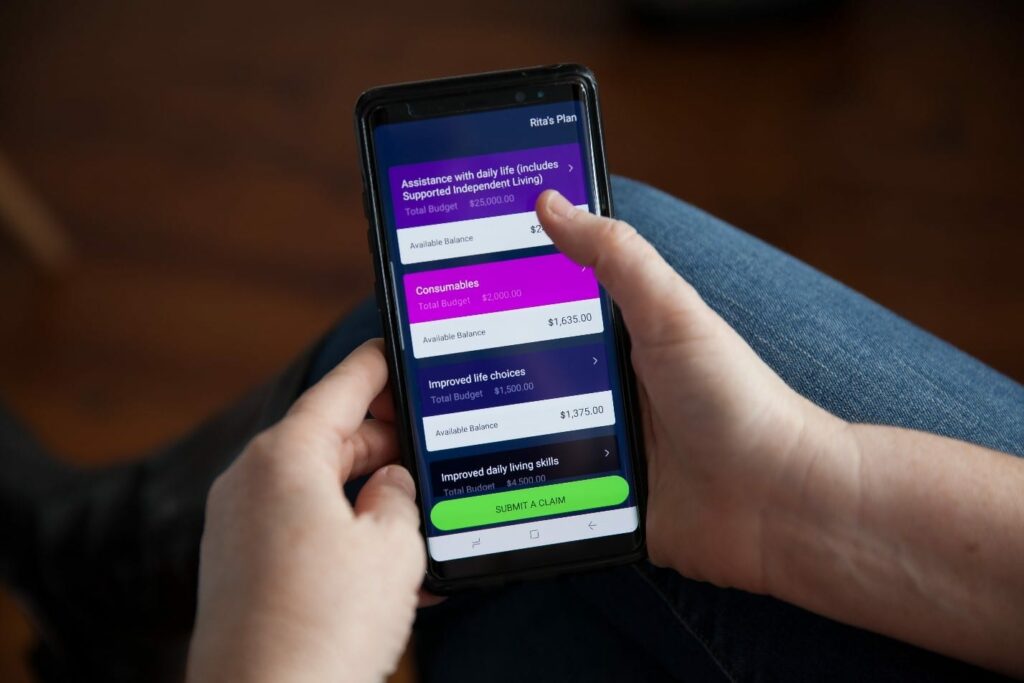

Use technology to keep up to date with your spending as it happens: many plan managers offer a client portal, and clients of My Plan Manager also have access to a mobile phone app. Ideally you want to be able to view your total amounts, the amount you have spent and show you past invoices so that you can plan for future spends. Monitoring over the life of your plan keeps the choice and control in your hands. If you don’t have access to an app or client portal, get regular updates from your plan manager or the NDIS portal.

If possible, when you plan or review your spending, keep a small percentage aside as an ‘emergency’ fund to help you avoid running out. You can use My Plan Manager’s budget calculator (free for all NDIS participants to use) to help you to work out your spending and make sure you won’t overspend. If you’re with My Plan Manager, our budget conversations and milestone checks will also help keep you on track.

The National Disability Insurance Agency (NDIA) makes frequent changes to rules around spending, and regularly updates their price guide. These announcements can impact the amount of support you receive and it’s a good idea to stay informed.

Following the NDIS on social media platforms like Facebook or Twitter is one of the simplest ways to make sure you’re in the know. There are also great resources like the Clickablog and The Growing Space which break down these often-confusing rulings into easy to understand language. The My Plan Manager blog is also updated regularly with useful information. If you are confused about any NDIA announcements, your plan manager should be able to help you to understand the information.

If you’re doing a halfway health check and are feeling concerned about your budgets, there are some ways you can be more creative with your spending. NDIS price guides are a maximum amount you can be charged for a specific support, service or product. If you can find a similar service that will charge under the price guide amount, you can make your NDIS money go further. Try searching on Clickability! For mainstream services like cooking or gardening, self or plan managed participants can use any service provider, not just NDIS-registered ones. Check with the NDIA or your plan manager if you’re unsure, but if you’re able to pay out of pocket and be reimbursed, you can avoid disclosing that you’re an NDIS participant and can sometimes receive cheaper services. Be sure to compare before you commit to any providers.

Sometimes things just happen, and your budget won’t be enough to last until the end of your plan. This is why it’s so important to keep an eye on your spending. If this happens, contact the NDIA or your LAC to let them know things have changed. If you’re plan managed, your plan manager should help you to go through this process. You need to do this as soon as you become aware: don’t leave it until the last minute.

See the NDIS website’s page, “I have a significant or urgent change in circumstances, and my plan no longer meets my needs”.

And if you end up with the opposite problem – money left at the end of your plan – then you need to read our blog article about at the end of your NDIS plan with funds left over, which will tell you exactly what to do!

Belle Owen is a writer, consultant and disability advocate with over ten years experience living and travelling overseas. She is passionate about social justice, human rights and disability representation in popular culture.